Earnings Paid to an Employee Based on an Hourly Rate

It is also used to determine the rate at which an employee accrues annual leave. If you work 375 hours a week divide your annual salary by 1950 375 x 52.

Free Employment Income Verification Letter Pdf Word Eforms Intended For Proof Of Income Lett Letter Of Employment Employment Letter Sample Letter Template Word

Employee was paid a piece rate of 036 per square foot for 16500 square feet during 400 hours of work in a 90-day period.

. 157 Higher duties a An employee engaged for 2 or more hours during one day on duties carrying a higher minimum rate than the employees ordinary classification must be paid the higher minimum rate for the day. If you are paid two or more rates by the same employer during the workweek the regular rate is the weighted average which is determined by dividing your total earnings for the workweek including earnings during overtime hours by the total hours worked during the workweek including the overtime hours. Based on how long a person has been in federal service.

Since 1997 pay in real terms has decreased in five years. Visit PayScale to research personal support worker psw hourly pay by city experience skill employer and more. This amount is reported as taxable wages on the employees W-2.

Compared with 1999 when the median full-time earnings amounted to. Incentive-based and time-based pay for retail salespersons in 2017. Changes to hours worked and the number of hours paid for have also contributed to changes in the employee earnings data particularly the derived measure of hourly earnings.

And the employer must. For example a non-residential employee who before overtime has piece rate earnings of 500 in a workweek for 50 hours work has a regular rate of 10 per hour. For example if you work 32 hours at 1100 an hour and 10 hours.

When an employee is paid on a non-hourly basis eg. Current agency employee works for. This suggests that in 2009 on average employees experienced an increase in hourly pay compared with 2008 but were working fewer hours.

His hourly rate for paid sick leave is 5940. You must calculate your employees normal hourly compensation based on the hourly rate they would have earned during the time they used paid sick leave. The average hourly pay for a Personal Support Worker PSW in Canada is C1871.

Box 1 Box 3 and 5 Box 16 Box 18 Paid to employee Rate times hours Advance - Taxable A taxable amount paid to employees in advance of their actually earning it. For school-based apprenticessee Schedule D School-based Apprentices. Normal hourly compensation is not necessarily the same as an employees hourly wage.

B If engaged for less than 2 hours during the day on. Figure 6 shows the proportion of ethnicities within each gross hourly pay quartile in 2018. When some or all of a California employees compensation is based on commissions California law requires the compensation agreement to be in writing 14 The agreement must specify the way the commissions will be computed and paid15.

Generally these required deductions are 1 federal income tax 2 Social Security 3 Medicare 4 state income tax 5 other state. The year 2009 marked a change where hours dropped from approximately 395 hours per week in 2008 and weekly earnings fell but hourly earnings grew. Date current pay period began.

These data also show the details of those. Finally the overtime rate is half the regular rate which the employee is then owed for each hour worked over 40 in the week. The average full-time salaried employee works 40 hours a week.

Pay quartiles split employees into four equal parts based on their earnings. Absent The hourly wage paid to an employee for time absent from work for an illness or for personal reasons. A non-exempt employee is covered by.

Minimum wage workers account for 43 percent of hourly paid workers in 2013 04032014 Real average hourly earnings up over the month and over the year 03212014 Employer cost for employee compensation 2963 per hour December 2013 03132014 Real average hourly earnings. Same as hourly rate. To determine your hourly wage divide your annual salary by 2080.

Based on this the average salaried person works 2080 40 x 52 hours a year. The median annual earnings for full-time employees in the United Kingdom was approximately 3128 thousand British pounds in 2021. RCW 49460103 defines who qualifies for paid sick leave as an employee Hourly employees.

TSP amtpct Fair Labor Standards Act. The first quartile contains the quarter of the employee population with the lowest earnings while the fourth quartile contains those employees with the highest earnings. Disposable earnings are the monies paid to the employee after you take out the deductions required by law.

The amount is reported as taxable. In some cases a reduction in the number of hours paid. National Compensation SurveyBenefits provides information on the share of workers who participate in specified benefits such as health insurance retirement plans and paid vacations.

To calculate disposable earnings subtract the amounts federal state or local laws require you to deduct from the employees gross pay. 1470 5880 for four Full. The employee must be provided with a copy of the written commission agreement.

Calculating overtime for an hourly employee is more basic. Piece work salary the regular hourly wage rate is found by dividing the total hours worked during the week into the employees total earnings. Employee 765 62 - OASDI 145 - HI 885360 No limit Employer 765 62 - OASDI 145 - HI 885360 No limit Self-employed 1530 124 - OASDI 29 - HI 1770720 No limit Earnings Required for a Quarter of Coverage in 2021.

If you make 75000 a year your hourly wage is 750002080 or 3606. Employer Costs for Employee Compensation present average hourly employer costs for employee compensation. The overtime rate is again one half the regular rate and an hourly employees regular rate is the same as his hourly rate unless he receives additional compensation under a separate payment.

The two ethnic groups with the highest. Max OASDI Max HI Employee 765 62 - OASDI 145 - HI 885360 No limit. If an employee is paid commission or piece rate then divide total compensation for previous 90 calendar days by number of hours worked and pay this rate.

Current department an employee works for.

Advance Paycheck Stub Paycheck Marital Status Paying

Employment Verification Form For Child Care How To Create An Employment Verification Form For Chi Employment Letter Sample Letter Template Word Letter Sample

Logicfoo Limited Java Program Solved Logicprohub Solving Hours In A Week Programming Tutorial

How To Calculate Earnings Based On A Timesheet Timesheet Template Calculator Templates

29 Free Payroll Templates Payroll Template Payroll Checks Statement Template

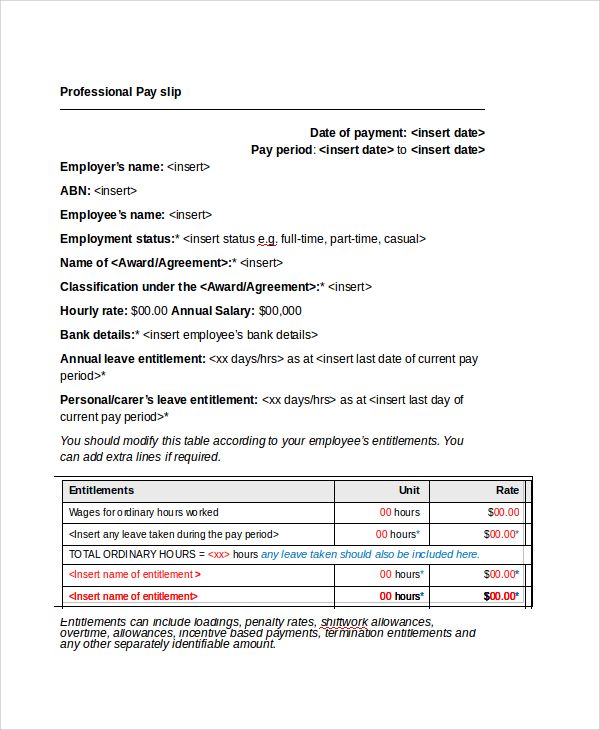

Salary Slip Templates 19 Free Printable Ms Docs Xlsx Templates Payroll Template Template Printable

Gross Salary Vs Net Salary Salary Budget Planning Medical Insurance

Download Daily Wages Spreadsheet Template Excel Excel Spreadsheet Templates Excel Budget Template Excel Spreadsheets Templates Spreadsheet Template

Overtime Is Money Employer Must Pay 1 5x For Even Salary Employees Learn More In This Flsa Infographi Financial Planning Business Entrepreneurship Fun Facts

14 Free Salary Slip Templates Ms Word Excel Pdf Samples Survey Template Microsoft Word Templates Word Template

Payslip Templates 28 Free Printable Excel Word Formats Templates Words Excel Templates

Payroll Statement Template Statement Template Payroll Template Payroll

47 Printable Employee Information Forms Personnel Information Sheets Templates Form Incident Report Form

Nanny Contract Template Nanny Contract Template Nanny Contract Contract Template

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Spreadsheet Template Templates

Contract Of Employment Template Fresh 40 Great Contract Templates Employment Construction Contract Template Templates Free Business Card Templates

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Payroll And Complete Pay Stubs With This Template Enter Tax Deductions Hourly Wage Then Log If Check Stub Template Template Site Payroll Template Templates

Blank Pay Stub Template Word Pay Stubs Template Throughout Blank Pay Stub Template Word Report Card Template Payroll Template Schedule Template

Comments

Post a Comment